Banco Sabadell, an important banking group in Spain and Europe, has recently strengthened Banking-as-a-Service strategy with Flanks, the global wealth data orchestrator. “Banking-as-a-service” is a revolutionary concept changing the banking industry as we know it, consisting of easily customizable API-based digital banking services like the one the Barcelona-based company offers.

Being equipped with modern technological and commercial resources, along with a multi-channel organization focused on customers and their needs, makes Banco Sabadell a national benchmark in the personal and business banking markets. But how did this recent journey start for the firm, and what role Flanks plays in all of this?

The added value

After almost five years of experience as a pioneer in the Spanish wealth industry, Flanks realized that the relationship with a bank goes beyond financial products: It’s also about having a relationship where technology, user experience, and enhancing customer loyalty are perfectly intertwined. For this reason, Banco Sabadell chose Flanks to be its official data channel. This means that Banco Sabadell intermediaries can count on all their client’s information directly integrated into their computer system through the custodian bank’s website. And such information will be consumed in the format of their choice to be analysed however suits them best. For example, Excel or CSV.

What challenge does it solve?

By offering Flanks as a third-party data channel solution, Banco Sabadell provides an optimized system with only high-quality data, which automated any type of technological relationship with the financial institution. Thanks to Flanks, technology is the last thing that Banco Sabadell clients will have to worry about.

“The agreement between Flanks and Banco Sabadell is a step further towards the consolidation of such joint forces created after the implementation of MIFID II. The collaboration will undoubtedly allow us to grow our business in both client and business volume”.

Javier Orbe - EAF Director at Banco Sabadell

The benefits for users

Integrating the solution by Flanks into Banco Sabadell won’t only help customers get a faster and global view of their investments, but also will build a proactive relationship between them and the financial entities. Plus, aligning with Flanks in this particular business area will improve the communication between Banco Sabadell's ISP (Investment Service Provider) collaborating entities and the custodian bank. And, in addition, they will get to have Flanks’ data channel service for free.

This initiative also aims for Sabadell's intermediaries to obtain information in a more orderly, faster and safer way. And although this service doesn’t have a direct impact on the final investor, it will have a positive impact on the service provided by intermediaries. And therefore, passing on that value to customers at no added cost.

Thanks to this collaboration between Banco Sabadell and Flanks, it is expected both brands establish deeper relationships with each other and encourage collaboration in the future. And all of this, for a mutual objective: Keep offering the best banking experience to customers.

Access the whitepaper:

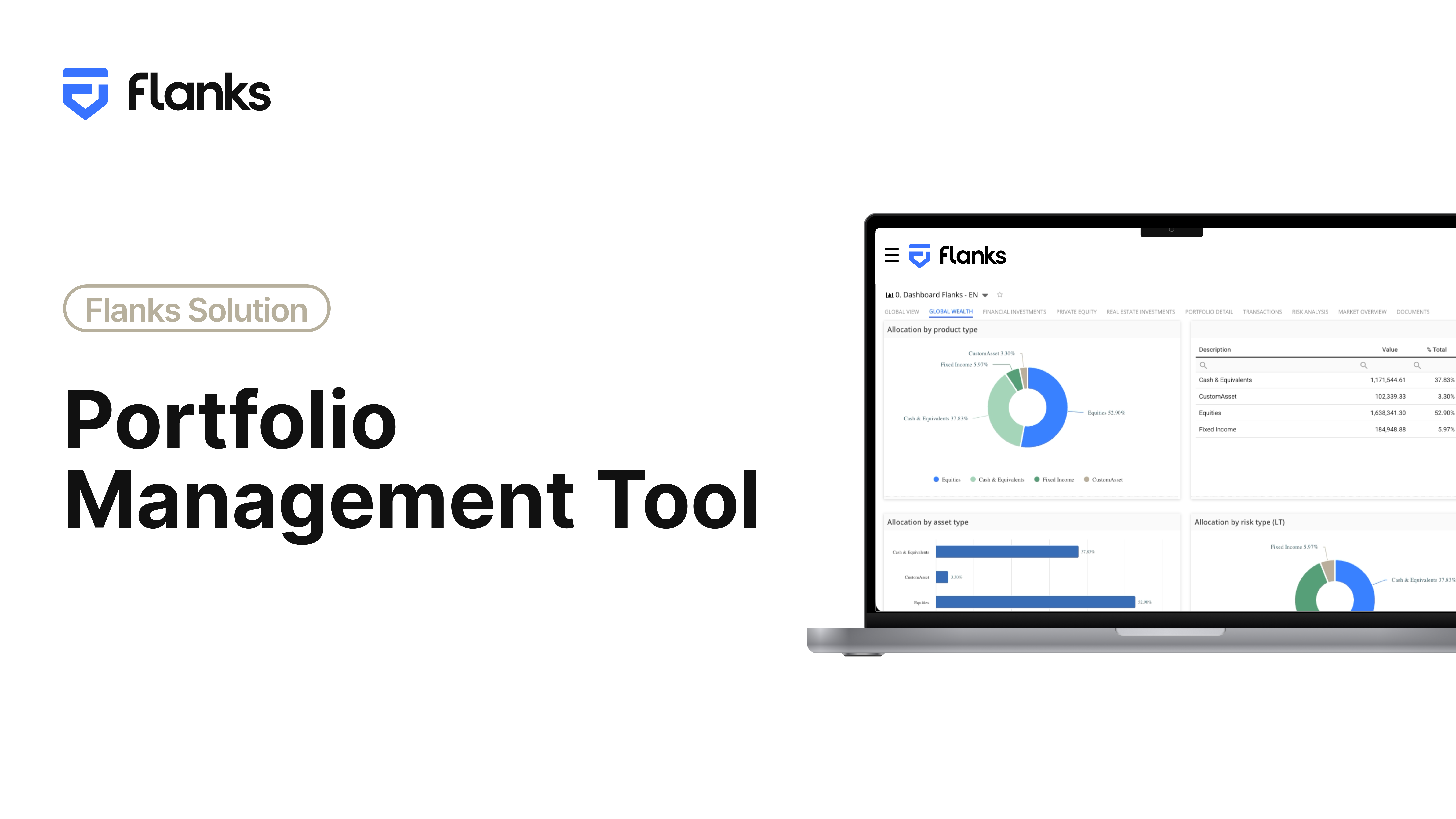

About Flanks

Flanks is a wealth management technology company (wealthtech) that is redefining the industry through automation and data-driven insights. Its modular and all-in-one solution empowers global financial institutions, including banks, family offices, asset managers, pension plan providers, and technology companies, to offer faster, higher-quality, and personalised advice by transforming complex and fragmented wealth data into valuable insights.

Flanks was founded in 2019 in Barcelona by Joaquim de la Cruz, Sergi Lao, and Álvaro Morales, former Global Head of Santander Private Banking. Currently, the company aggregates data from 600+ connections with global financial institutions and processes more than 500,000 portfolios per month in over 33 countries, managing assets worth more than €39 billion. For more information, visit flanks.io.