In recent years, the financial industry has gone through a significant transformation, with the emergence of regulatory changes related to the Open Finance and Open Banking initiatives. One of the most significant developments is the rise of Account Information Service Providers (or AISPs) like Flanks, which play an important role in the wealth management industry.

AISPs are companies that provide account aggregation services. They help customers manage their finances by gathering information from different financial accounts and presenting it in one place, usually through a mobile app or website. But why are they essential in the current wealth management scenario, and why should you take them into consideration?

The context

The implementation of the PSD2 regulation in Europe opened up the market for third-party providers to access financial data. This has enabled AISPs to offer new and innovative services that were previously unavailable. Also, as digitalization continues to transform the financial industry, wealth management customers and users are increasingly demanding convenient and easy-to-use services to manage their assets.

What is an AISP, and what benefits do they offer?

An AISP is a third-party service provider that aggregates data from different financial accounts and presents it to consumers in a clear and organized format. This allows individuals and businesses to view all their financial information in one place, making it easier to manage their wealth and make informed financial decisions. AISPs provide a user-friendly interface that allow clients to access their financial information quickly and easily, using their mobile phone or computer. This not only improves the client experience, but also helps wealth managers to retain clients by offering a more comprehensive service.

It’s also worth emphasising that, with cybercrime on the rise, clients are more concerned about the security of their financial data. AISPs do not have access to customers' login credentials, such as usernames and passwords. Instead, they use secure application programming interfaces (APIs) to access customers' account data, only with their explicit consent beforehand. Besides, that means that users can revoke access to their accounts at any time.

Flanks as an Account Information Service Provider

As an AISP, Flanks is regulated by financial authorities like the Bank of Spain, which means they must follow strict rules and guidelines to ensure that they protect their customers' data and operate in a safe and transparent way. It also goes through auditory sessions by external companies like Deloitte to ensure they comply with their monitoring and security requirements. Here you can find Flanks’ banking license.

In summary, being an AISP in the wealth management industry is becoming increasingly important due to the benefits it offers both wealth managers and their clients. By providing a holistic view of a client's financial situation, AISPs enable wealth managers to offer more personalized and customized advice. The convenience and user-friendly interface of AISPs also help to retain clients and enhance their experience. Finally, the enhanced security of AISPs helps to build trust between clients and their wealth management firms, which is crucial in the current climate of increased cybersecurity threats.

Access the whitepaper:

About Flanks

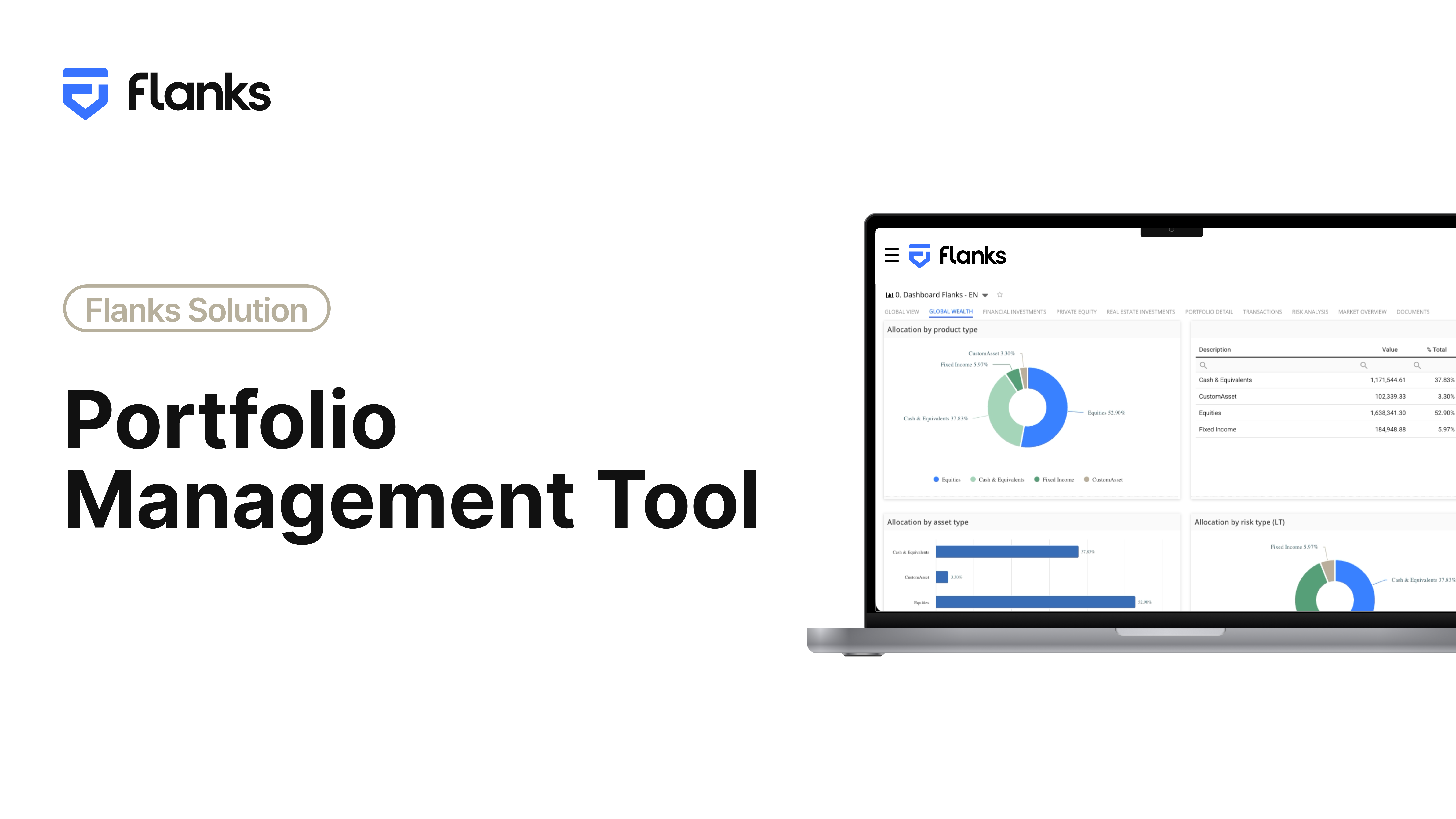

Flanks is a wealth management technology company (wealthtech) that is redefining the industry through automation and data-driven insights. Its modular and all-in-one solution empowers global financial institutions, including banks, family offices, asset managers, pension plan providers, and technology companies, to offer faster, higher-quality, and personalised advice by transforming complex and fragmented wealth data into valuable insights.

Flanks was founded in 2019 in Barcelona by Joaquim de la Cruz, Sergi Lao, and Álvaro Morales, former Global Head of Santander Private Banking. Currently, the company aggregates data from 600+ connections with global financial institutions and processes more than 500,000 portfolios per month in over 33 countries, managing assets worth more than €39 billion. For more information, visit flanks.io.

.png)